Gen Z

&

Investing

Project Overview

Digital banking has become a trend, it’s easier, faster, and time-saving. However, we want to get the next young adult generation, Gen Z, to be familiar with banking, and give them a sense of what to do with their money.

My Role

In this project, I co-lead the group through the design process, and highly participated in every step, especially in creating prototypes with Figma.

Challenge

Design an immersive solution for anyone belonging to Gen Z and capable of managing their own money. In order to bring them closer to the concept of saving and investment.

Support the design decisions with measurable and comparable data.

Use a clear, usable, and scalable data visualization model.

Design Process

1. Discover

Research

Hypotheses

Interview

2. Define

Opportunities

3. Ideate

Solution

3. Create

Prototype

Discover

Research

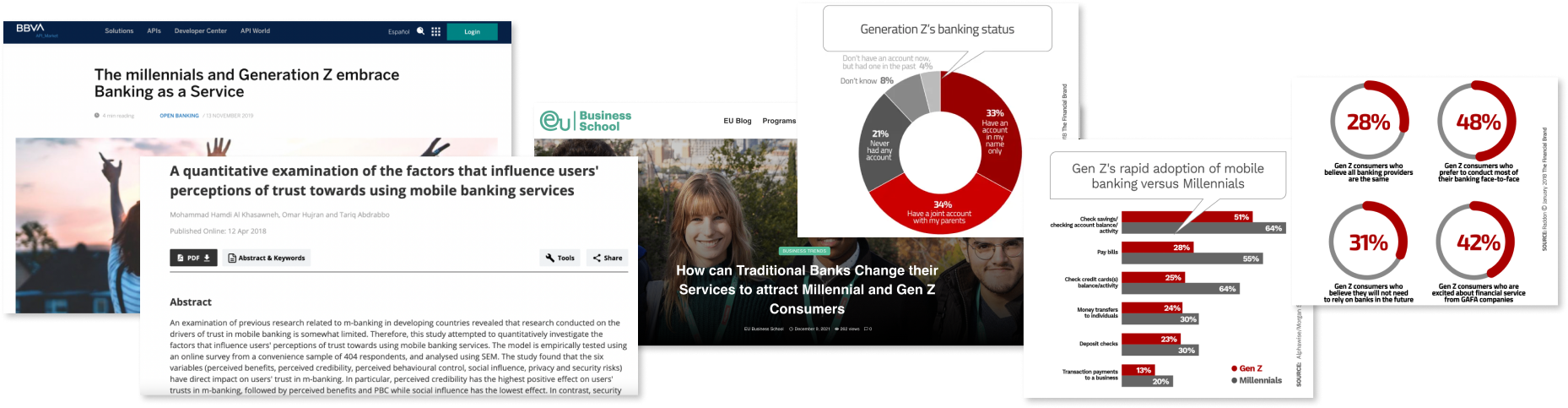

Starting with desk research of online/digital banks and Gen Z’s habit of banking. And by combining the information together some patterns were found.

Findings

“Generation Z seems don’t need the financial sector. They’ve lived through the economic crisis, and they believe that part of the blame should go to the banks. But this is not the only reason that distances them from banks. There is also the fact that they have been born with technology and demand a very good user experience from any company.”

Hypotheses

With some understanding of Gen Z and digital banking, the first hypotheses were able to be stated. Since this was a more open-ended project, having hypotheses in the beginning helped to shape the initial draft and have a clear perspective of goals within the team.

Gen Z is not interested in traditional banking because they’re more used to digital and technological gadgets and processes.

Gen Z is not interested in saving/investment because these things take time but Gen Z is used to faster, and more instant results.

Interview

In order to learn more about the target users, 15 people were interviewed. They have various backgrounds which provided more fulfilled insights.

The interviewees are :

– Between 16 to 23 years old

– From different countries

– In different fields of study

Insights

- Most know it takes time to get a return on investments, but each person has a different timeline in mind.

- Most prefer to use a digital bank than a physical one.

- Most believe that to start investing, they need to have saved a big sum first.

- Some already have savings, but very few have invested. (Most that invested have a background in business and finance)

- All understand the importance of investing, but they don’t think now it’s the right time to do it.

Define

Opportunities

From all the findings above, the relationships between Gen Z and digital banking were clear. 3 opportunities from different perspective of Gen Z and digital banking were identified.

1.

The Reason

Gen Z don’t invest because of the lack of knowledge, or unrealistic and incorrect beliefs.

2.

The Drive

Gen Z don’t know because learning isn’t interesting or clear enough for beginners.

3.

The Medium

Gen Z prefer the convenience of digital, especially when dealing with banks.

Ideate

Solution

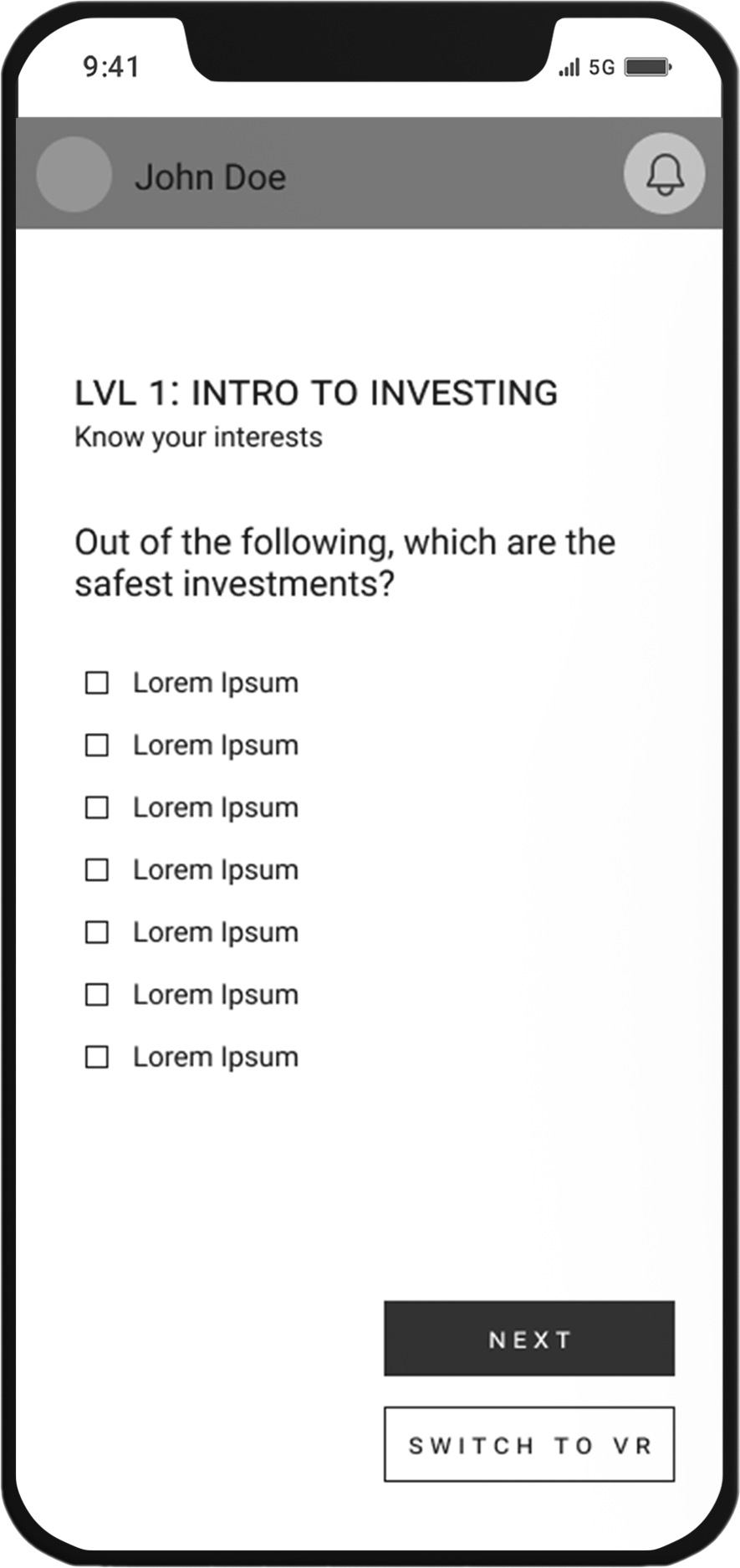

An Educational Game App

Gen Z can now learn about investment in an easy and fun way :

– Complete the questions to go to the next level.

– Collect stars by getting the questions correct.

– Use stars to make investments in the market.

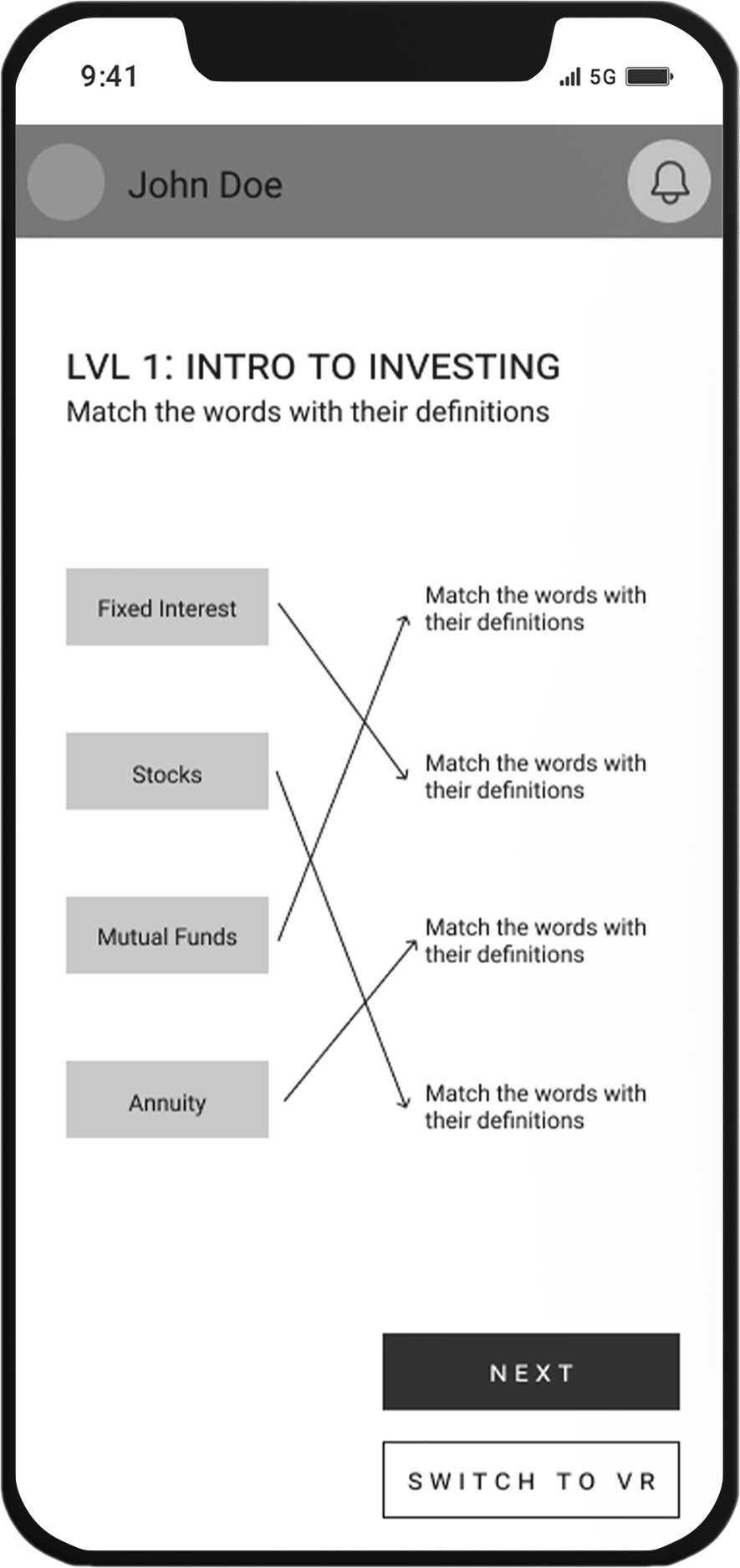

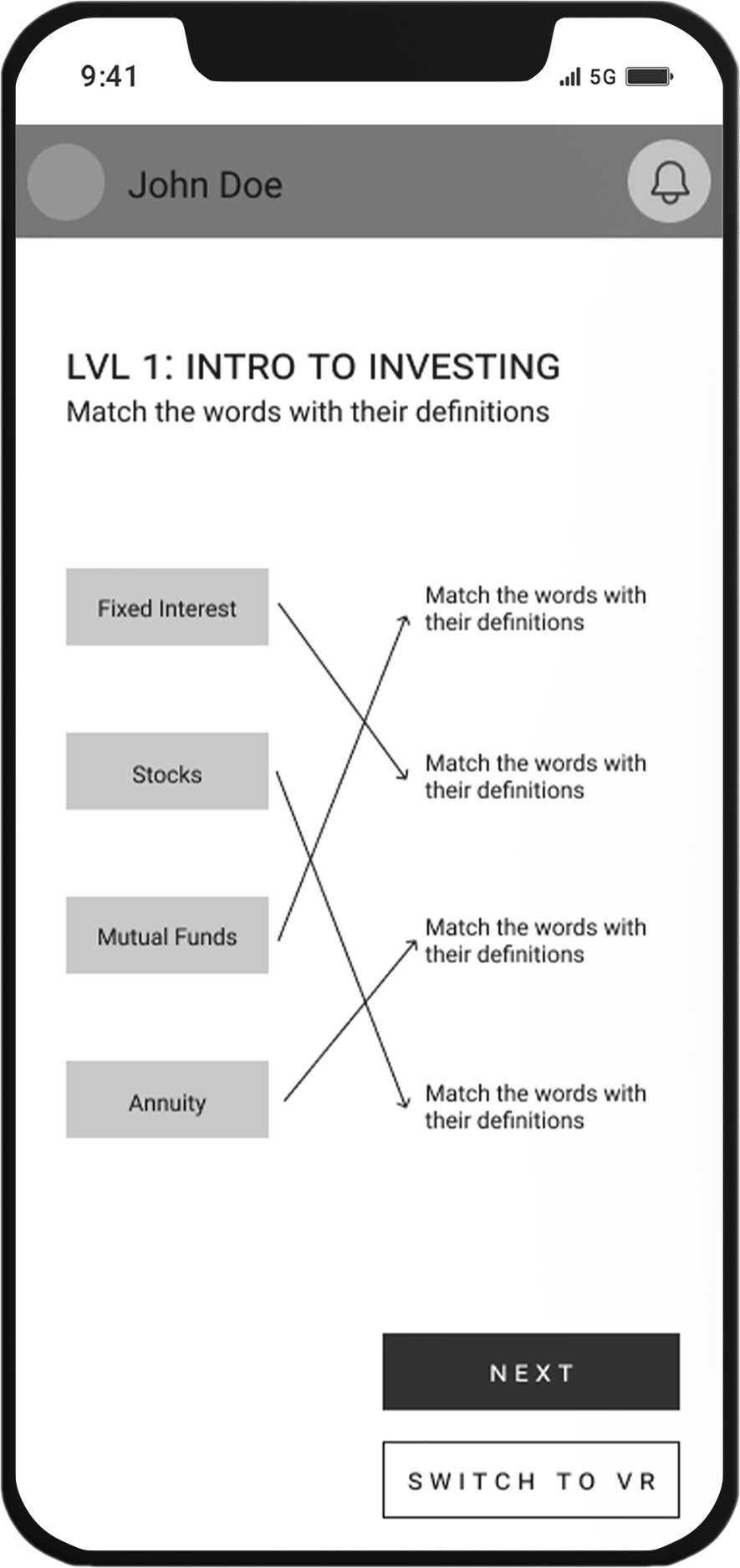

– In game mode, tap on “switch to VR” to get an immersive experience.

Create

Prototype

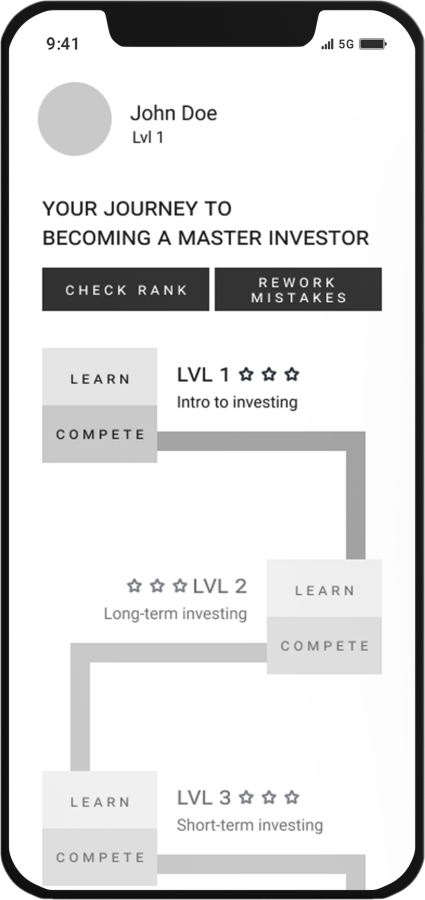

Game home page

There are multiple levels of the game, and they all have different topics related to investment. Each level has two sections, learn and compete. Users have to pass the level to get to the next one.

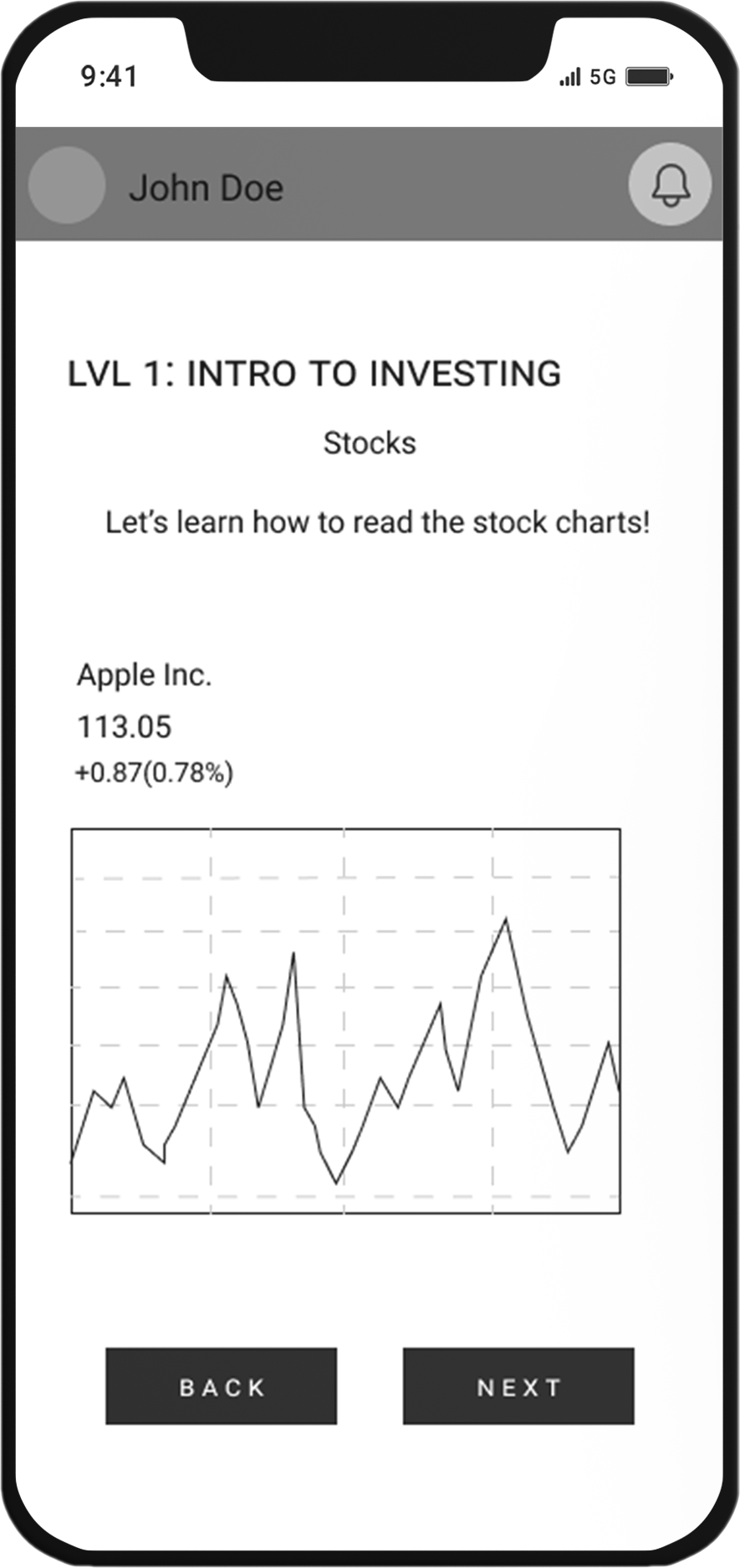

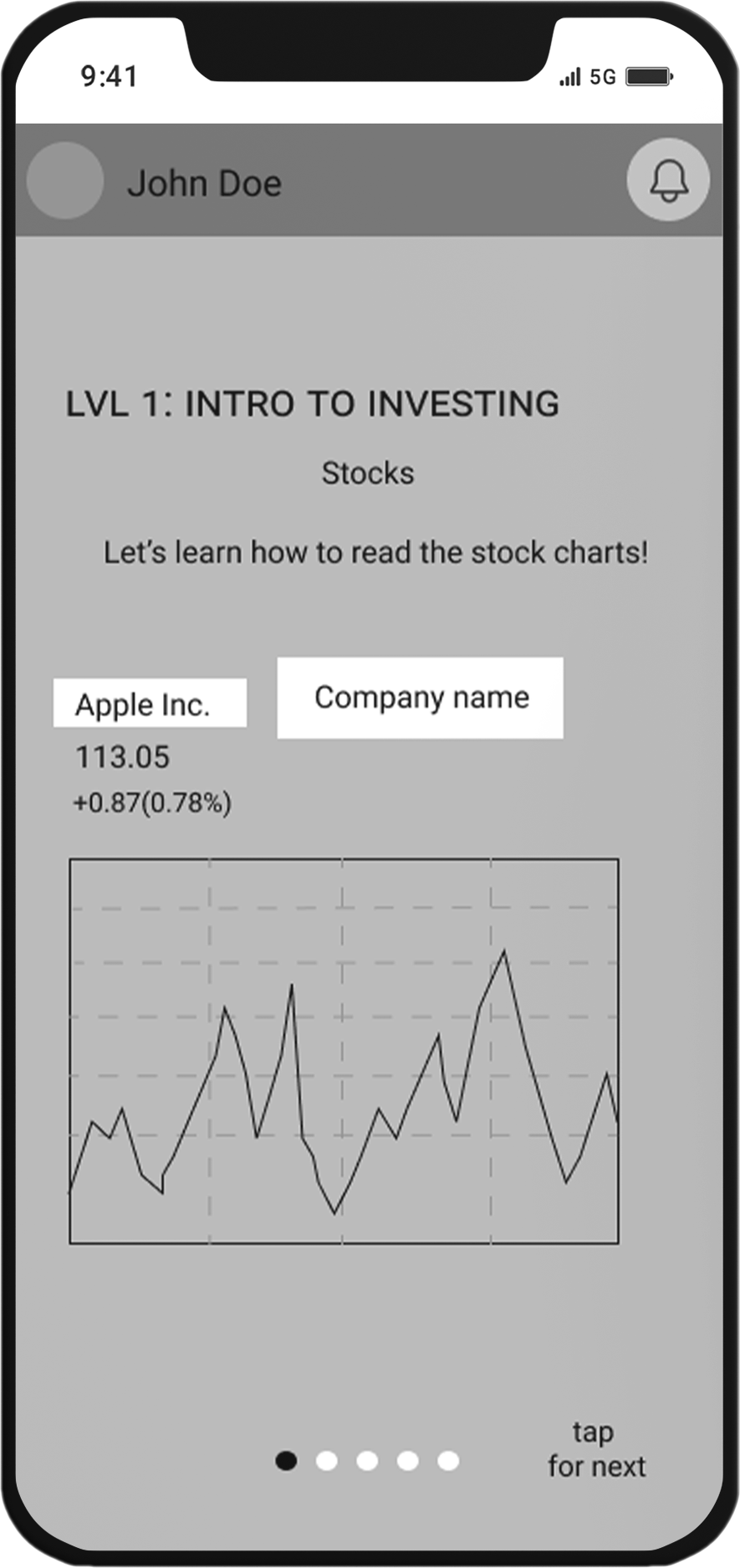

Learn

Users can go to the learn section before competing. Here have some short introductions of the knowledge related to the topic.

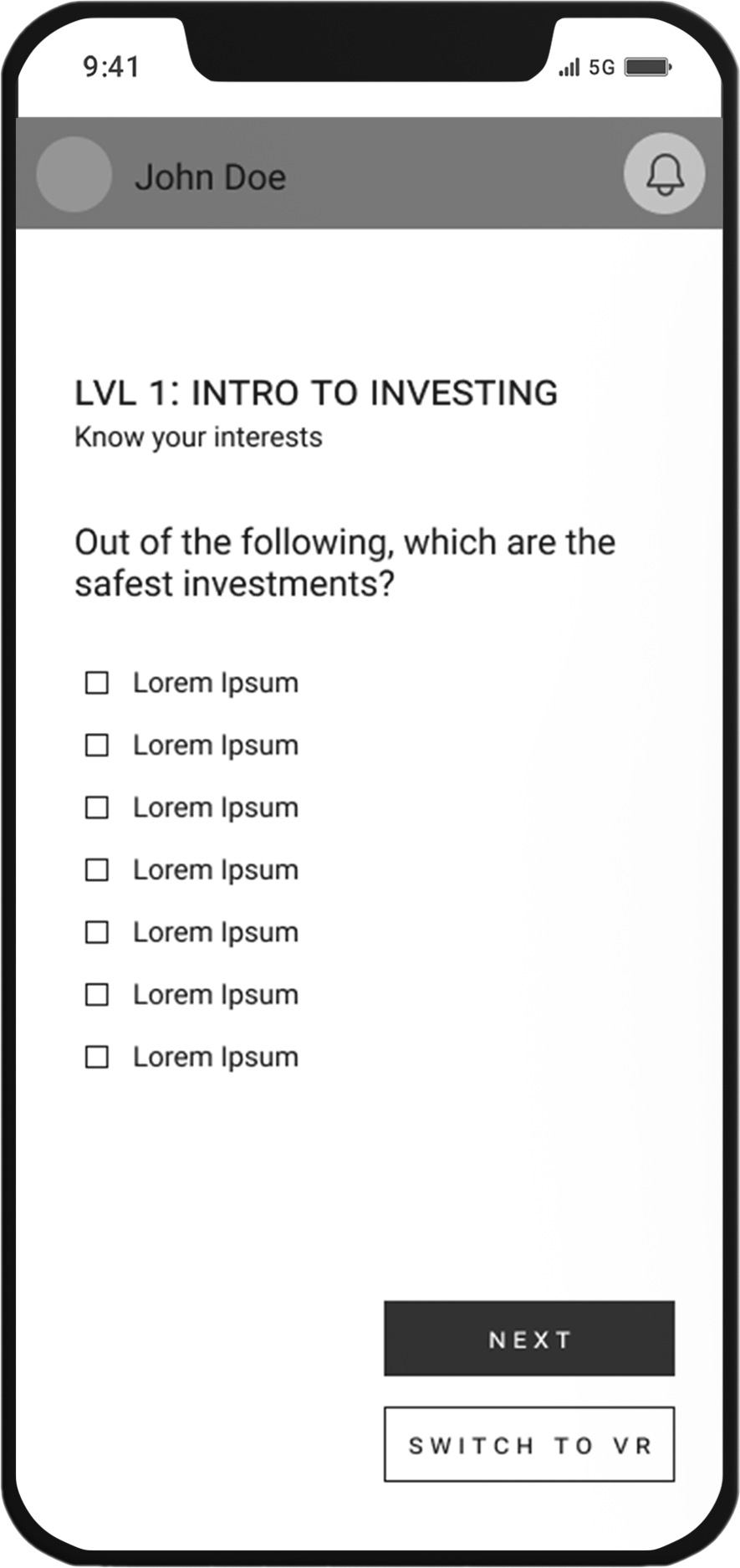

Compete

In the compete section, there are different types of questions that are related to the topic, users have to answer them correctly to pass.

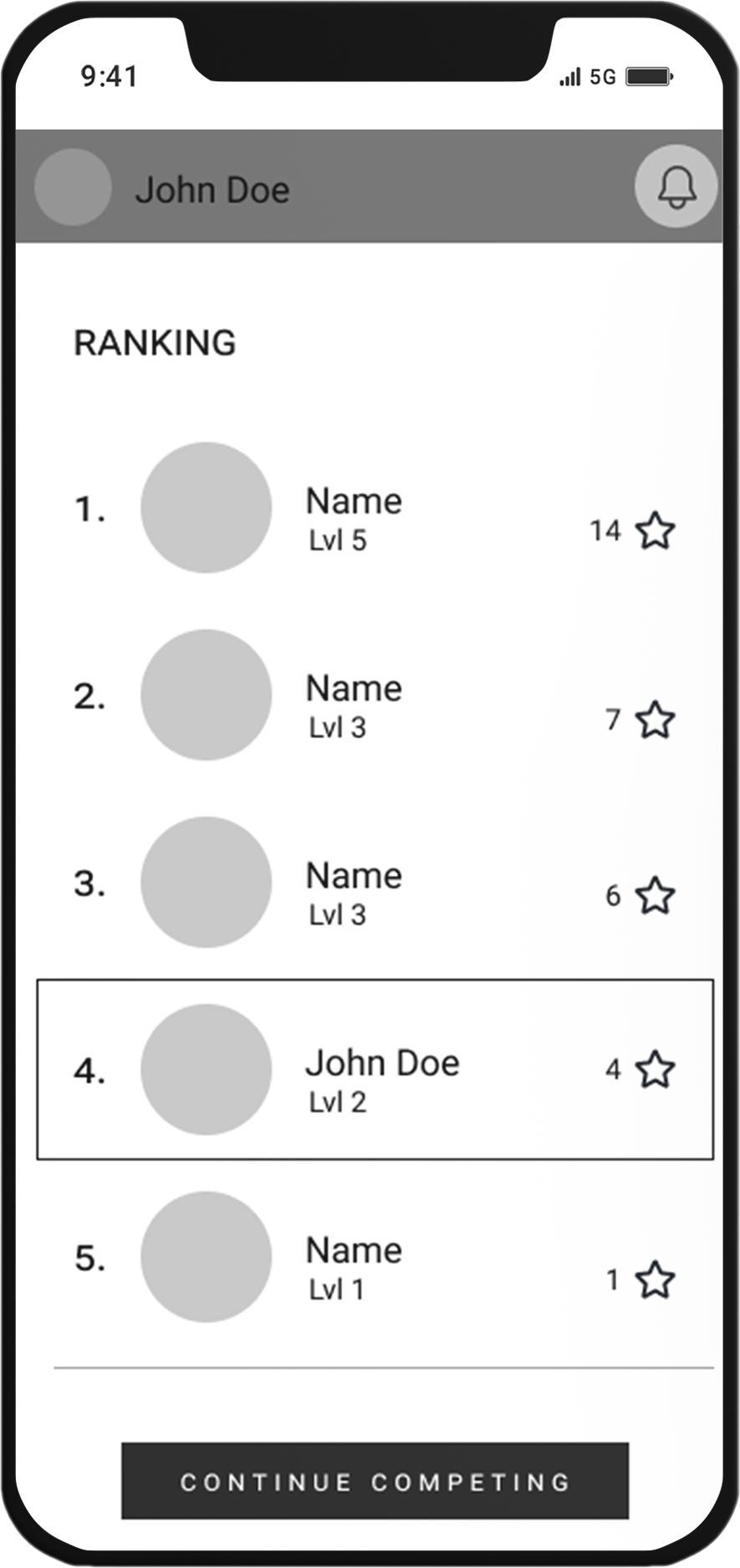

Award and ranking system

With the stars that the user has earned from playing games, he/she can see the ranking place compare to other users. It gives users motivation to use the app.

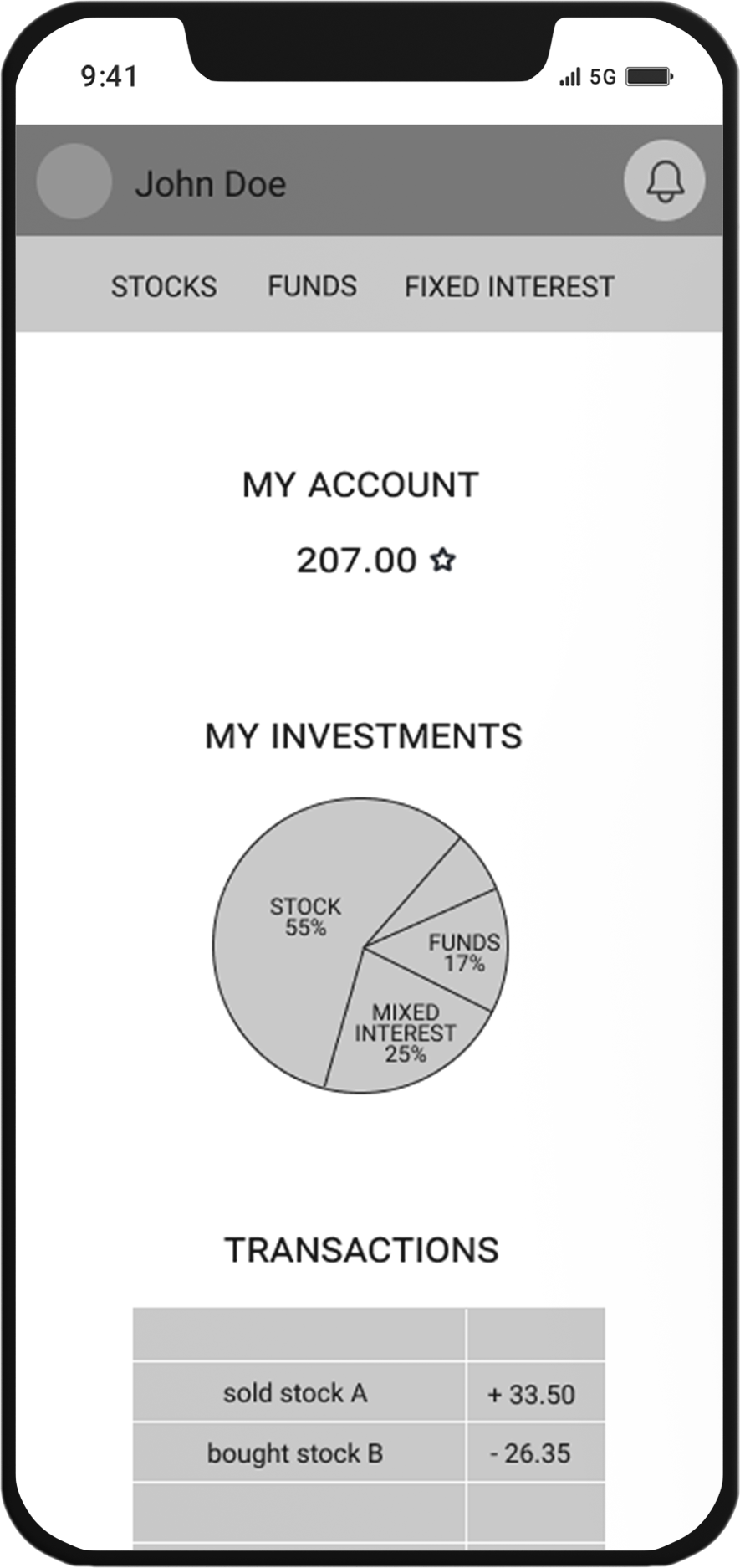

Investment market

Users can use the stars they earned to practice investing in the market in the app. They can buy stocks, funds, and other investing methods.